Essay

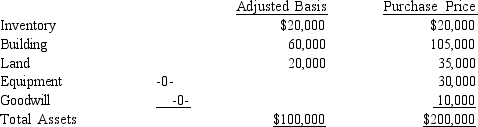

Dorothy operates a pet store as a sole proprietorship. During the year she sells the business to Florian for $200,000. The assets sold and the allocation of the purchase price are as follows:  Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land. She paid $40,000 for

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land. She paid $40,000 for

the equipment in the same year. What are the tax consequences of the liquidation for Dorothy?

the equipment in the same year. What are the tax consequences of the liquidation for Dorothy?

Correct Answer:

Verified

Dorothy will recognize a Section 1231 ga...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Discuss two tax-planning techniques that can be

Q22: Passive activity loss limitation rules do not

Q22: Byron is a partner in the Dowdy

Q42: During the current year the Newport Partnership

Q51: The Polaris S Corporation has operating income

Q60: Malcolm receives a liquidating distribution of land

Q60: When a partner receives a cash distribution

Q65: The Serenity Corporation distributes $200,000 in cash

Q79: A corporation's calculation of the maximum allowable

Q88: Boston Company, an electing S corporation, has