Short Answer

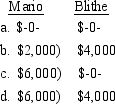

Mario receives a liquidating distribution of land with a fair market value of $19,000 and a basis of $15,000 from Blithe Corporation, an S corporation. Mario's basis in the stock is $21,000. What must Mario and Blithe report as income loss) from the property distribution?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Peter owns 30% of Bear Company, an

Q35: Lane Inc., an electing S corporation, realizes

Q37: The Gilpin Partnership has an operating loss

Q44: Calvin Corporation, has the following items of

Q45: Joline operates Adventure Tours as a sole

Q62: Anna owns 20% of Cross Co., an

Q67: Hammond Inc., sells a building that it

Q85: A partner's basis is increased by the

Q89: Fender Corporation makes a cash distribution of

Q93: When a partnership distributes property that has