Essay

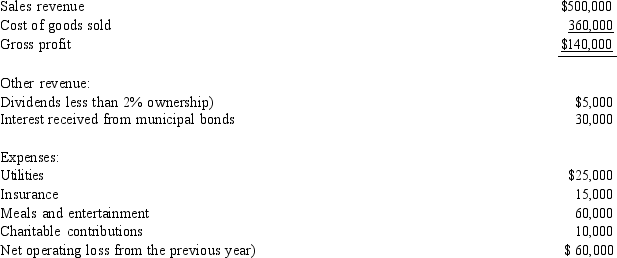

Calvin Corporation, has the following items of income and expense for the current year. Calculate a) Calvin's taxable income and b) income tax liability.

Correct Answer:

Verified

a)Calvin's taxable income is $10,000; b)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a)Calvin's taxable income is $10,000; b)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q4: Peter owns 30% of Bear Company, an

Q10: The amount of the dividend on a

Q20: Laurie and Lodi are dentists who have

Q37: The Gilpin Partnership has an operating loss

Q45: Joline operates Adventure Tours as a sole

Q47: Mario receives a liquidating distribution of land

Q62: Anna owns 20% of Cross Co., an

Q67: Hammond Inc., sells a building that it

Q74: Rona owns 3% of Theta Corporation and

Q89: Fender Corporation makes a cash distribution of