Essay

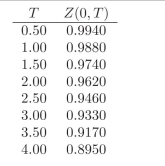

You are given the following discount factors:  You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: What is an American Call option?

Q4: What is a European Put option?

Q5: What does mark-to-market mean?

Q6: What is to tail the hedge?

Q7: Under what conditions are futures and forwards

Q8: What is an American Put option?

Q9: What are the shortcomings of futures, when

Q10: What will be the value of a

Q11: What are the advantages of futures contracts,

Q39: What is a margin call?