Short Answer

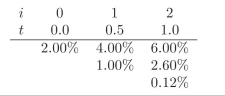

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a call option on a 1.5 year zero coupon bond with K = 99.00, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

Correct Answer:

Verified

The price ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: You are given the following interest rate

Q3: What is one major drawback from using

Q4: Compute the spot rate duration for a

Q5: You are given the following interest rate

Q6: How realistic is it to speak about

Q8: In order to compute the spot rate

Q9: Which of the following prices should be

Q10: What is the difference between risk neutral

Q11: Why do we say that the dynamic

Q12: Using risk neutral pricing obtain the value