Multiple Choice

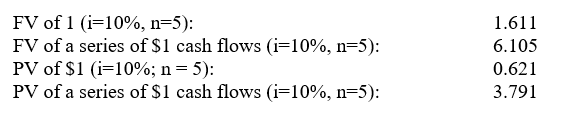

Carlin Company, which uses net present value to analyze investments, requires a 10% minimum rate of return. A staff assistant recently calculated a $500,000 machine's net present value to be $86,400, excluding the impact of straight-line depreciation.

If Carlin ignores income taxes and the machine is expected to have a five-year service life, the correct net present value of the machine would be:

A) $(13,600) .

B) $86,400.

C) $186,400.

D) $292,700.

E) $465,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A company's hurdle rate is generally influenced

Q17: Consider the following statements about the accounting

Q18: Which of the following would not involve

Q19: Which of the following is taken into

Q20: Inflation is defined as a decline in

Q22: Marcus & Tyler sells frozen custard and

Q23: Krate Inc. is considering a $600,000 investment

Q24: The payback period is best defined as:<br>A)

Q25: The incremental-cost approach looks at the difference

Q26: All expenses represent cash outflows.