Essay

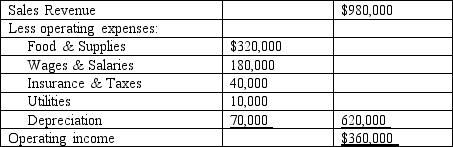

Marcus & Tyler sells frozen custard and sandwiches. It is considering a new site that will require a $2 million investment for land acquisition and construction costs. The following operating results are expected:

Disregard income taxes.

Required:

A. If management requires a payback period of four years or less, should the new site be opened? Why?

B. Compute the accounting rate of return on the initial investment.

C. What significant limitation of payback and the accounting rate of return is overcome by the net-present-value method?

Correct Answer:

Verified

A. Annual net cash inflows: $980,000 ‒ (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Consider the following statements about the accounting

Q18: Which of the following would not involve

Q19: Which of the following is taken into

Q20: Inflation is defined as a decline in

Q21: Carlin Company, which uses net present value

Q23: Krate Inc. is considering a $600,000 investment

Q24: The payback period is best defined as:<br>A)

Q25: The incremental-cost approach looks at the difference

Q26: All expenses represent cash outflows.

Q27: A company used the net-present-value method to