Multiple Choice

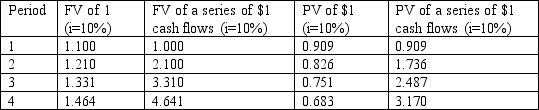

A new asset is expected to provide service over the next four years. It will cost $500,000, generates annual cash inflows of $150,000, and requires cash operating expenses of $30,000 each year. In addition, a $10,000 overhaul will be needed in year 3.

If the company requires a 10% rate of return, the net present value of this machine would be:

A) $(127,110) , and the machine meets the company's rate-of-return requirement.

B) $(127,110) , and the machine does not meet the company's rate-of-return requirement.

C) $(129,600) , and the machine does not meet the company's rate-of-return requirement.

D) $(151,700) , and the machine meets the company's rate-of-return requirement.

E) None of the answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: Upton evaluates future projects by using the

Q102: Barton Company can acquire a $900,000 machine

Q103: A company that is using the internal

Q104: The internal rate of return equates the

Q105: There is no adjustment in the payback

Q107: Nominal dollars is another name for real

Q108: When income taxes are considered in capital

Q109: A new machine is expected to produce

Q110: If a company desires to be in

Q111: A company that uses accelerated depreciation:<br>A) would