Multiple Choice

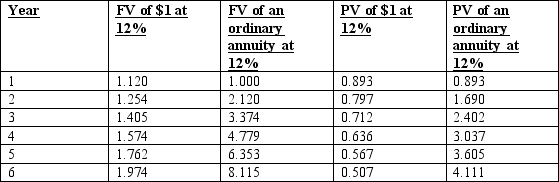

A new machine is expected to produce a MACRS deduction in three years of $50,000.

If the company has a 12% after-tax hurdle rate and is subject to a 30% income tax rate, the correct discounted net cash flow to include in an acquisition analysis would be:

A) $0.

B) $10,680.

C) $24,920.

D) $46,280.

E) None of the other answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: The internal rate of return equates the

Q105: There is no adjustment in the payback

Q106: A new asset is expected to provide

Q107: Nominal dollars is another name for real

Q108: When income taxes are considered in capital

Q110: If a company desires to be in

Q111: A company that uses accelerated depreciation:<br>A) would

Q112: Twilight Corporation will evaluate a potential investment

Q113: San Marco has a $4,000,000 asset investment

Q114: Grenada Company is contemplating the acquisition of