Essay

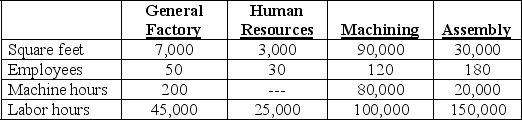

Tempest Industries has two service departments (General Factory and Human Resources) and two production departments (Machining and Assembly). The company uses the direct method of service-department cost allocation, allocating General Factory cost on the basis of square feet and Human Resources cost on the basis of employees. Budgeted allocation-base and operating data for the four departments follow.

Additional information:

· Budgeted costs of General Factory and Human Resources respectively amount to $1,560,000 and $950,000.

· The anticipated overhead costs incurred directly in the Machining and Assembly Departments respectively total $3,650,000 and $2,340,000.

· The manufacturing overhead application bases used by Tempest's production departments are: Machining, machine hours; Assembly, labor hours.

· Company policy holds that a department's overhead application rate is based on a department's own overhead plus an allocated share of service-department cost.

Required:

A. Allocate the company's service-department costs to the producing departments.

B. Compute the overhead application rates for Machining and Assembly.

Correct Answer:

Verified

Application rates:

Application rates:

Machining:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Machining:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Use the following information to answer the

Q2: Which of the following methods accounts for

Q3: Claremore Electronics, Inc. manufactures gauges for automobile

Q4: Clandestine Corporation allocates joint costs by using

Q5: Consider the following statements about service department

Q7: The step-down method of service department cost

Q8: The joint-cost allocation method that recognizes the

Q9: Use the following information to answer the

Q10: Use the following information to answer the

Q11: A company that uses activity-based costing would