Essay

Clandestine Corporation allocates joint costs by using the net-realizable-value method. In the company's Texas plant, products D and E emerge from a joint process that costs $250,000. E is then processed at a cost of $220,000 into products F and

Required:

A. Allocate the $220,000 processing cost between products F and

B. From a profitability perspective, should product E be processed into products F and G? Show your calculations.

C. Assume that the net realizable value associated with E is zero. How would you allocate the joint cost of $250,000?

G.

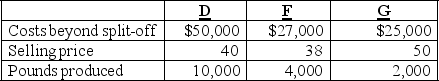

G. Data pertaining to D, F, and G follow.

Required:

Required:

Correct Answer:

Verified

B. No, the company is losing $20,000: N...

B. No, the company is losing $20,000: N...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Use the following information to answer the

Q2: Which of the following methods accounts for

Q3: Claremore Electronics, Inc. manufactures gauges for automobile

Q5: Consider the following statements about service department

Q6: Tempest Industries has two service departments (General

Q7: The step-down method of service department cost

Q8: The joint-cost allocation method that recognizes the

Q9: Use the following information to answer the

Q10: Use the following information to answer the

Q11: A company that uses activity-based costing would