Multiple Choice

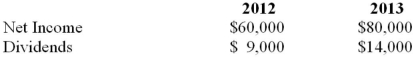

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 chapters) earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. Assuming that Hanson had no recorded goodwill prior to January 1, 2012, what would be the amount of goodwill appearing on Hanson's December 31, 2012 consolidated balance sheet?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. Assuming that Hanson had no recorded goodwill prior to January 1, 2012, what would be the amount of goodwill appearing on Hanson's December 31, 2012 consolidated balance sheet?

A) $75,000.

B) $80,000.

C) $117,000.

D) $195,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Whine purchased 80% of the outstanding voting

Q13: The following information pertains to the shareholdings

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" All intercompany investments

Q15: Whine purchased 80% of the outstanding voting

Q17: A Inc. owns 80% of B's outstanding

Q17: The following information pertains to the shareholdings

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $84,000. B)

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $12,600. B)

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) 21% B)

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) ($5,000). B)