Multiple Choice

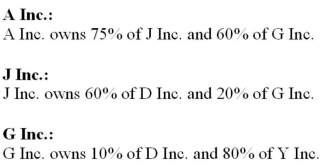

The following information pertains to the shareholdings of an affiliated group of companies. The respective ownership interest of each company is outlined below.  All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:  Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:

Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:  All companies are subject to a 25% tax rate. How much is the non-controlling interest in A Inc.'s Consolidated Net Income for 2012?

All companies are subject to a 25% tax rate. How much is the non-controlling interest in A Inc.'s Consolidated Net Income for 2012?

A) Nil.

B) $382,500.

C) $373,875.

D) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The following information pertains to the shareholdings

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" All intercompany investments

Q15: Whine purchased 80% of the outstanding voting

Q16: On January 1, 2012, Hanson Inc. purchased

Q17: A Inc. owns 80% of B's outstanding

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $84,000. B)

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $12,600. B)

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) 21% B)

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) ($5,000). B)

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)