Multiple Choice

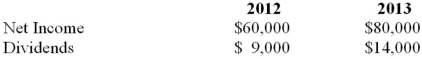

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 chapters) earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What is the amount of the acquisition differential amortization for 2012 (excluding goodwill impairment) ?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What is the amount of the acquisition differential amortization for 2012 (excluding goodwill impairment) ?

A) $4,375

B) $5,625

C) $6,250

D) $12,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is not included

Q13: Assuming that A acquired a controlling interest

Q34: On January 1, 2012, Hanson Inc. purchased

Q36: On January 1, 2012, Hanson Inc. purchased

Q37: Whine purchased 80% of the outstanding voting

Q39: On January 1, 2012, Hanson Inc would

Q41: Whine purchased 80% of the outstanding voting

Q42: On January 1, 2012, Hanson Inc. purchased

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) 14% B)

Q60: Which of the following statements pertaining to