Multiple Choice

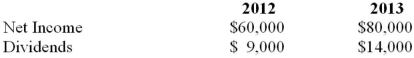

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common stock and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. By how much would the non-controlling interest amount have changed as a result of the Hanson's second purchase?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. By how much would the non-controlling interest amount have changed as a result of the Hanson's second purchase?

A) A decrease of $43,975.

B) A decrease of $37,857.

C) An increase of $37,857.

D) An increase of $43,975.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is not included

Q36: On January 1, 2012, Hanson Inc. purchased

Q37: Whine purchased 80% of the outstanding voting

Q38: On January 1, 2012, Hanson Inc. purchased

Q39: On January 1, 2012, Hanson Inc would

Q41: Whine purchased 80% of the outstanding voting

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) 14% B)

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q60: Which of the following statements pertaining to

Q62: What is the correct method of treating