Multiple Choice

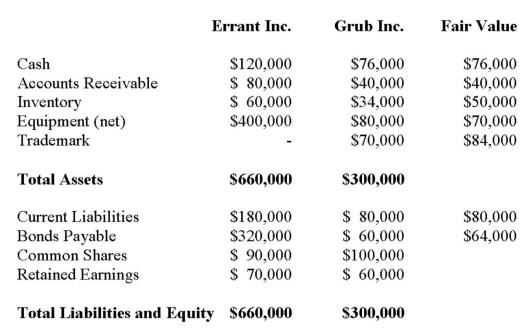

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. Which of the following journal entries would be required on December 31, 2012 to record the Impairment of the Goodwill?

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. Which of the following journal entries would be required on December 31, 2012 to record the Impairment of the Goodwill?

A) No entry is required.

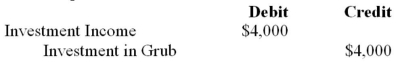

B)

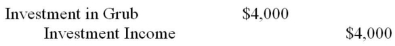

C)

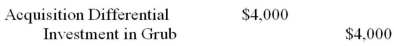

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Big Guy Inc. purchased 80% of the

Q4: Big Guy Inc. purchased 80% of the

Q5: Big Guy Inc. purchased 80% of the

Q6: GNR Inc. owns 100% of NMX Inc.

Q7: Consolidated Shareholders' Equity:<br>A) does not include any

Q8: Which of the following adjustments (if any)

Q9: Big Guy Inc. purchased 80% of the

Q10: GNR Inc. owns 100% of NMX Inc.

Q11: Big Guy Inc. purchased 80% of the

Q42: The rationale behind allocating goodwill across a