Multiple Choice

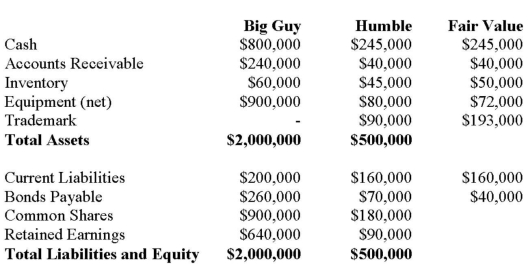

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

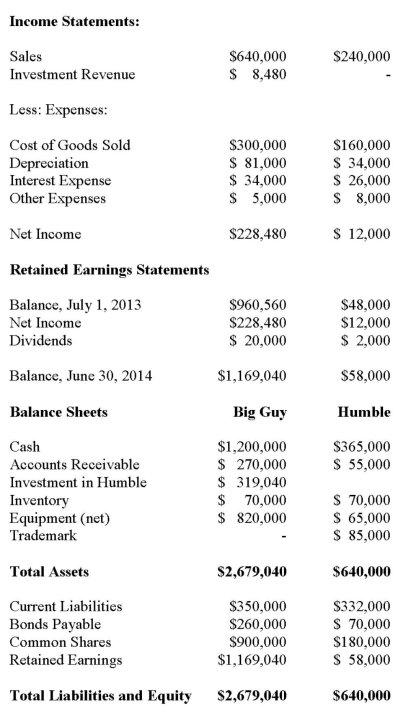

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:  An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of other expenses appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of other expenses appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

A) $11,600.

B) $12,000.

C) $13,000.

D) $13,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Errant Inc. purchased 100% of the outstanding

Q3: Big Guy Inc. purchased 80% of the

Q5: Big Guy Inc. purchased 80% of the

Q6: GNR Inc. owns 100% of NMX Inc.

Q7: Consolidated Shareholders' Equity:<br>A) does not include any

Q8: Which of the following adjustments (if any)

Q9: Big Guy Inc. purchased 80% of the

Q10: GNR Inc. owns 100% of NMX Inc.

Q11: Big Guy Inc. purchased 80% of the

Q42: The rationale behind allocating goodwill across a