Multiple Choice

The consolidation elimination entry required to remove any dividends received from a subsidiary prior to the preparation of Consolidated Financial statements (assuming that the parent uses the cost method to record its investment in the sub) would be:

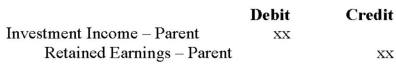

A)

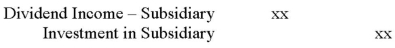

B)

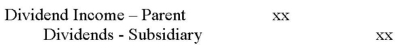

C)

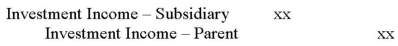

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Errant Inc. purchased 100% of the outstanding

Q29: Big Guy Inc. purchased 80% of the

Q30: Errant Inc. purchased 100% of the outstanding

Q31: Under the Equity Method, which of the

Q32: Errant Inc. purchased 100% of the outstanding

Q34: Big Guy Inc. purchased 80% of the

Q35: Errant Inc. purchased 100% of the outstanding

Q36: Errant Inc. purchased 100% of the outstanding

Q37: Testing intangible assets with indefinite useful lives

Q38: Big Guy Inc. purchased 80% of the