Multiple Choice

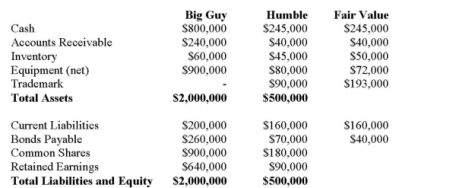

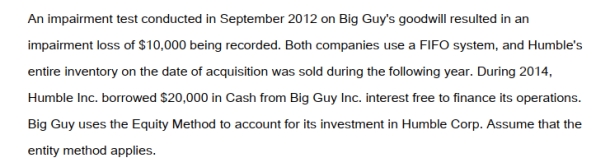

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

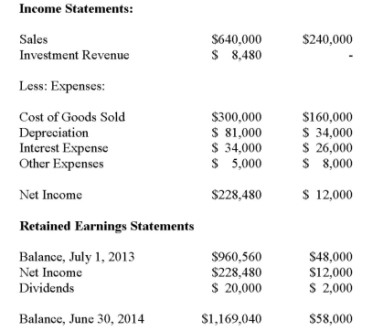

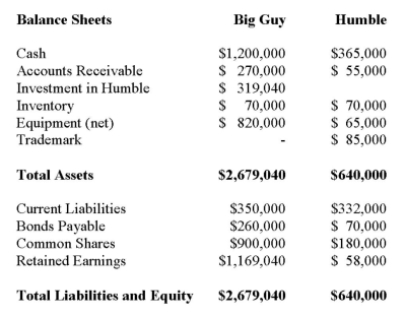

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

A) $872,000.

B) $878,600.

C) $881,800.

D) $885,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Errant Inc. purchased 100% of the outstanding

Q25: Big Guy Inc. purchased 80% of the

Q26: Big Guy Inc. purchased 80% of the

Q28: Errant Inc. purchased 100% of the outstanding

Q30: Errant Inc. purchased 100% of the outstanding

Q31: Under the Equity Method, which of the

Q32: Errant Inc. purchased 100% of the outstanding

Q33: The consolidation elimination entry required to remove

Q34: Big Guy Inc. purchased 80% of the

Q64: Which of the following statements best describes