Essay

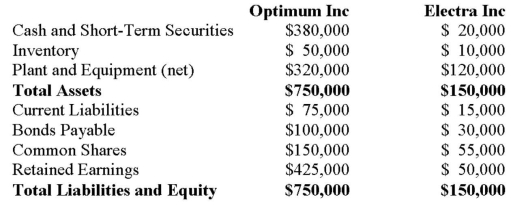

On April 1, 2012, the balance sheets of Optimum Inc. and Electra Inc. were as follows:  On that date, the fair values of Electra's Assets and Liabilities were as follows:

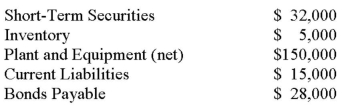

On that date, the fair values of Electra's Assets and Liabilities were as follows:  On April 1, 2012, Optimum issued 5,000 new common shares with a market value of $50.00 per share as consideration for Electra's net assets. Prior to the issue, Optimum had 10,000 outstanding common shares. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Optimum's acquisition of Electra's assets. c) Prepare Optimum's Consolidated Balance Sheet immediately following its acquisition of Electra's assets. d) Prepare Electra's Balance Sheet following the acquisition.

On April 1, 2012, Optimum issued 5,000 new common shares with a market value of $50.00 per share as consideration for Electra's net assets. Prior to the issue, Optimum had 10,000 outstanding common shares. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Optimum's acquisition of Electra's assets. c) Prepare Optimum's Consolidated Balance Sheet immediately following its acquisition of Electra's assets. d) Prepare Electra's Balance Sheet following the acquisition.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following is NOT considered

Q16: How should intangible assets which are readily

Q24: One company is considering entering into a

Q25: Which of the following statements is correct?<br>A)

Q27: ABC123 Inc has decided to purchase 100%

Q28: When are parent companies allowed to comprehensively

Q30: IAS 27 outlines the requirements for identifying

Q31: Company Inc. owns all of the outstanding

Q33: Zen Inc. owns 35% of Sun Inc.'s

Q34: Assume that two companies wish to engage