Essay

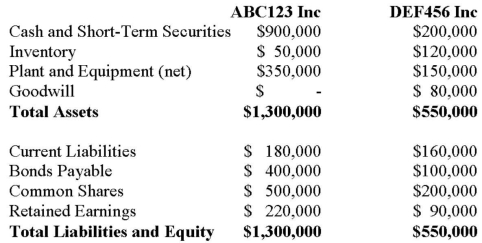

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

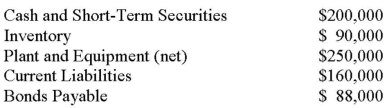

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

Correct Answer:

Verified

On July 1, 2012, ABC123 purchased 100% o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following is NOT considered

Q16: How should intangible assets which are readily

Q24: One company is considering entering into a

Q25: Which of the following statements is correct?<br>A)

Q28: When are parent companies allowed to comprehensively

Q28: On April 1, 2012, the balance sheets

Q30: IAS 27 outlines the requirements for identifying

Q31: Company Inc. owns all of the outstanding

Q33: Zen Inc. owns 35% of Sun Inc.'s

Q33: AInc. purchased 100% of B Inc.'s voting