Essay

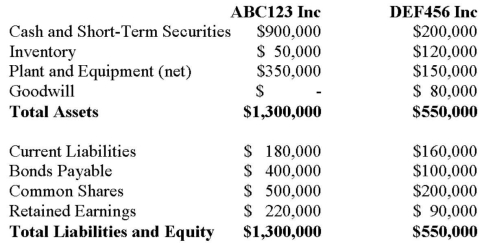

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

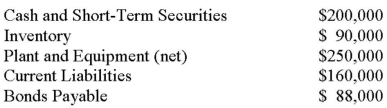

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Assuming that DEF456's Plant and Equipment was worth $400,000. Calculate the goodwill arising from this business combination and state how it would be shown in the consolidated balance sheet on the acquisition date.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Assuming that DEF456's Plant and Equipment was worth $400,000. Calculate the goodwill arising from this business combination and state how it would be shown in the consolidated balance sheet on the acquisition date.

Correct Answer:

Verified

The new Purchase Price discrepancy would...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: A Corporation had net income of $50,000

Q14: Telecom Inc has decided to purchase the

Q14: Company A has made an offer to

Q18: Which of the following statements is correct?<br>A)

Q21: A Inc. purchases 100% of the voting

Q31: How is negative goodwill treated under the

Q33: AInc. purchased 100% of B Inc.'s voting

Q49: 1234567 Inc. is contemplating a Business Combination

Q50: The process of preparing Consolidated Financial Statements

Q55: Which of the following is NOT considered