Essay

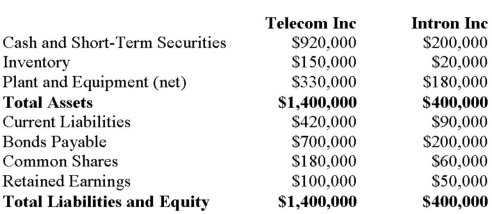

Telecom Inc has decided to purchase the shares of Intron Inc. for $300, 000 in Cash on July 1,2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of Intron's Assets and Liabilities were as follows:

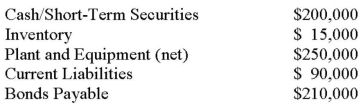

On that date, the fair values of Intron's Assets and Liabilities were as follows:  Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following conditions need NOT

Q10: Company A makes an offer to purchase

Q11: Telecom Inc has decided to purchase the

Q13: A Corporation had net income of $50,000

Q17: ABC123 Inc has decided to purchase 100%

Q18: Which of the following statements is correct?<br>A)

Q31: How is negative goodwill treated under the

Q49: 1234567 Inc. is contemplating a Business Combination

Q50: The process of preparing Consolidated Financial Statements

Q55: Which of the following is NOT considered