Essay

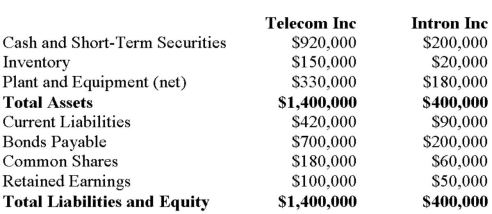

Telecom Inc has decided to purchase the shares of Intron Inc. for $300, 000 in Cash on July 1,2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of Intron's Assets and Liabilities were as follows:

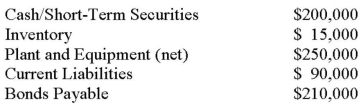

On that date, the fair values of Intron's Assets and Liabilities were as follows:  Assume that Intron's Assets and Liabilities were purchased instead of its shares for $300,000. Prepare the journal entry to record this purchase.

Assume that Intron's Assets and Liabilities were purchased instead of its shares for $300,000. Prepare the journal entry to record this purchase.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: On December 31, 2012, A Company has

Q8: Parent and Sub Inc. had the following

Q9: Which of the following conditions need NOT

Q10: Company A makes an offer to purchase

Q13: A Corporation had net income of $50,000

Q14: Telecom Inc has decided to purchase the

Q49: 1234567 Inc. is contemplating a Business Combination

Q50: The process of preparing Consolidated Financial Statements

Q55: Which of the following is NOT considered

Q56: Which of the following is NOT required