Multiple Choice

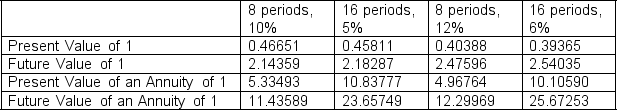

Brown Company is about to issue $300,000 of 8-year bonds paying a 12% interest rate with interest payable semiannually. The effective interest rate for such securities is 10%. Below are available time value of money factors that Brown chooses from to calculate compounded interest.  To the closest dollar, how much can Brown expect to receive for the sale of these bonds?

To the closest dollar, how much can Brown expect to receive for the sale of these bonds?

A) $319,339

B) $229,371

C) $332,513

D) $540,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Why might a company redeem bonds before

Q61: Barkley Brothers Inc. shows the following information

Q61: If a company issues a note payable

Q62: On January 1, 2009 Frank Corporation issued

Q64: Torrey Corporation issued $1,000,000 of ten-year, 10

Q67: On January 1, 2009, Pacific Corporation issued

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt=" -On January 1,

Q69: Bowlin Company issued $1,000,000 of 9 percent,

Q70: Which one of the following is not

Q73: If an interest-bearing note payable is issued