Essay

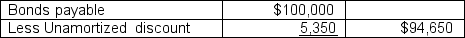

Barkley Brothers Inc. shows the following information on its balance sheet for December 31, 2010.

The bonds have a stated annual interest rate of 5 percent and will mature on December 31, 2012. The market value of the bonds as of December 31, 2010, is $98,167. Assume that Barkley retired the bonds by purchasing them on the open market. The journal entry to record this purchase would include:

The bonds have a stated annual interest rate of 5 percent and will mature on December 31, 2012. The market value of the bonds as of December 31, 2010, is $98,167. Assume that Barkley retired the bonds by purchasing them on the open market. The journal entry to record this purchase would include:

a. a credit to Bonds Payable for $100,000.

b. a debit to Discount on Bonds Payable for $5,350.

c. a credit to Discount on Bonds Payable for $5,350.

d. a debit to Cash for $98,167.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Why might a company redeem bonds before

Q56: On January 1, 2009, Lundell Corporation issued

Q57: On January 1, 2010, Everton Company leased

Q58: Duncan Industries sold $100,000 of 12 percent

Q59: On January 1, 2009, Edison Corporation issued

Q61: If a company issues a note payable

Q62: On January 1, 2009 Frank Corporation issued

Q64: Torrey Corporation issued $1,000,000 of ten-year, 10

Q65: Brown Company is about to issue $300,000

Q73: If an interest-bearing note payable is issued