Essay

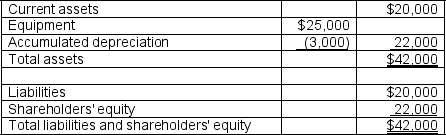

On January 1, 2009, Grant Company leased telephone equipment from Xu, Inc. Grant uses straight-line depreciation. The contract requires Grant to pay $5,000 each December 31 for the next three years, at which time the equipment is to be returned to Xu. Using an interest rate of 8%, the present value of the lease payments is $12,885. The following is Grant's January 1, 2009, balance sheet before the lease agreement.

Calculate and compare Grant's debt/equity ratios on January 1, 2009, immediately after the lease is signed, as an operating lease and a capital lease.

Calculate and compare Grant's debt/equity ratios on January 1, 2009, immediately after the lease is signed, as an operating lease and a capital lease.

Correct Answer:

Verified

The liability and shareholders' equity s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: How do debt covenants impact a company's

Q34: On January 1, a 5-year, $5,000 non-interest-bearing

Q60: Distinguish between an installment obligation and a

Q85: Which one of the following is one

Q89: A provision of a contractual obligation that

Q115: Perfectly effective hedges using interest rate swaps

Q119: On January 1, 2009, Seaside Company leased

Q120: On January 1, 2009, Action Corporation issued

Q121: Darren Company issued $8,000 of 8% bonds

Q122: On December 31, 2009, Creative Corporation issued