Essay

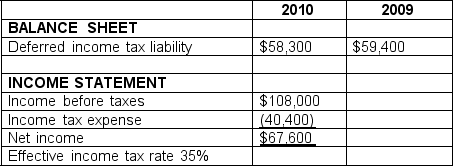

The following information was taken from the annual report of Leno Inc.

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

Based on this information, what journal entry should Leno make in 2010 to record its income taxes?

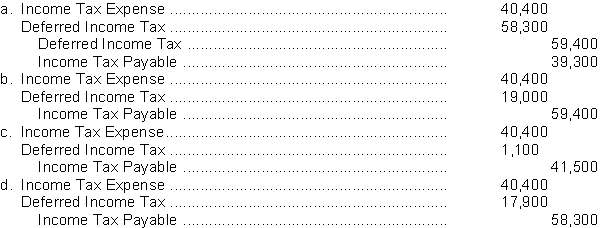

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: On October 1, Accurate Company borrowed $2,000

Q26: Which one of the following would most

Q68: What concerns might management have with additional

Q82: On July 1, Falcon Company borrowed $2,000

Q83: On March 2, 2010, Knight Company's CFO,

Q88: Deposits payable may arise because<br>A) cash deposits

Q89: Porter Products recognizes expenses for wages, interest

Q90: Beacon Incorporated owns a chain of retail

Q92: Howell Incorporated current income statement and December

Q99: Pension expense is<br>A)accrued each period as employees