Essay

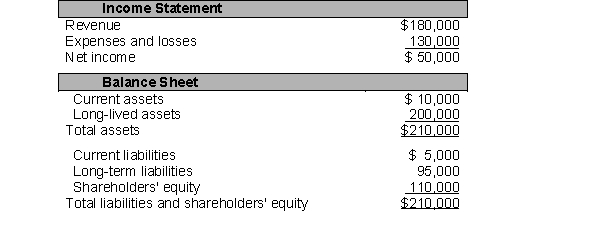

Howell Incorporated current income statement and December 31 balance sheet follow:  During an audit of Howell's current financial statements, its auditor discovered that Howell is a defendant in a $20,000 lawsuit for infringement of patent rights. Howell's management, under the advice of its legal counsel, decided that it was only reasonably probable that they would lose the suit and have to pay $20,000. However, its auditor disagreed with the treatment of the contingent loss and effectively argued that it is probable that the lawsuit will require Howell to pay $20,000 in the forthcoming year. The management of Howell decided to "take a bath" and treat the $20,000 lawsuit consistent with GAAP on probable conditional liabilities.

During an audit of Howell's current financial statements, its auditor discovered that Howell is a defendant in a $20,000 lawsuit for infringement of patent rights. Howell's management, under the advice of its legal counsel, decided that it was only reasonably probable that they would lose the suit and have to pay $20,000. However, its auditor disagreed with the treatment of the contingent loss and effectively argued that it is probable that the lawsuit will require Howell to pay $20,000 in the forthcoming year. The management of Howell decided to "take a bath" and treat the $20,000 lawsuit consistent with GAAP on probable conditional liabilities.

A. Reconstruct Howell current income statement and 12/31 balance sheet under the auditor's judgment concerning the $20,000 lawsuit

B. Calculate and compare current, debt/equity, and debt/asset ratios resulting from Howell's initial and reconstructed financial statements. Comment on Howell's solvency.

Correct Answer:

Verified

A.  B.

B.

All ratios as an indication of ...

All ratios as an indication of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Accounts payable typically arise because<br>A)cash is received

Q43: A company has a decreasing current ratio.

Q70: How do 'determinable' current liabilities differ from

Q87: The following information was taken from the

Q88: Deposits payable may arise because<br>A) cash deposits

Q89: Porter Products recognizes expenses for wages, interest

Q90: Beacon Incorporated owns a chain of retail

Q93: Jake Company borrowed $100,000 from Guaranty Trust

Q97: Select the letter of the effect on

Q99: Pension expense is<br>A)accrued each period as employees