Essay

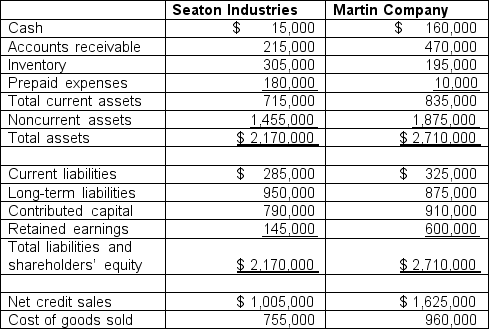

-You have just been hired as a loan officer for Coastline Bank and Trust. Seaton Industries and Martin Company have both applied for $125,000 nine-month loans. It is the strict policy of the bank to have only $1,350,000 outstanding in unsecured loans at any point in time. Since the bank currently has $1,210,000 in unsecured loans outstanding it will be unable to grant loans to both companies. The bank president has given you the following selected information from the companies' loan applications.

Required: Assume that all account balances on the balance sheet are representative of the entire year. Based on this limited information, which company would you recommend to the bank president as the better risk for an unsecured loan? Support your answer with any relevant analysis, including examination of the current ratio, quick ratio, receivables turnover, and inventory turnover.

Required: Assume that all account balances on the balance sheet are representative of the entire year. Based on this limited information, which company would you recommend to the bank president as the better risk for an unsecured loan? Support your answer with any relevant analysis, including examination of the current ratio, quick ratio, receivables turnover, and inventory turnover.

Correct Answer:

Verified

As a loan officer, there should be conce...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The following information is presented from the

Q2: Xenon, a major defense contractor, was faced

Q3: The following information is presented from the

Q4: The net income amounts for Box and

Q6: The following information is presented from the

Q7: Carlton Electronics posted net income of $500,000

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt="

Q9: When looking at the statement of comprehensive

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt="

Q11: The following chart presents the cash flow