Essay

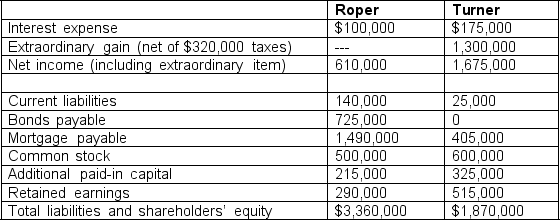

-The following selected financial information was obtained from the 2010 financial reports of Roper Designs and Turner Industries:

Required:

Required:

a. Assume that you are considering purchasing the common stock of one of these companies. (Since you have limited data, assume that the beginning balance sheet amounts equal ending balance sheet amounts for total assets and stockholders' equity.) Based on this information, which company has a higher return on equity? Would your conclusion be different if the impact of the extraordinary item had not been included in net income? Should the extraordinary item be considered? Why or why not?

b. Which company uses leverage more effectively? Does your answer change if you do not consider the impact of the extraordinary item on net income?

Correct Answer:

Verified

a. Return on Equity = Net Income ÷ Avera...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The following information is presented from the

Q4: The net income amounts for Box and

Q5: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt="

Q6: The following information is presented from the

Q7: Carlton Electronics posted net income of $500,000

Q9: When looking at the statement of comprehensive

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5406/.jpg" alt="

Q11: The following chart presents the cash flow

Q12: The following information was taken from the

Q13: You are reviewing the annual report for