True/False

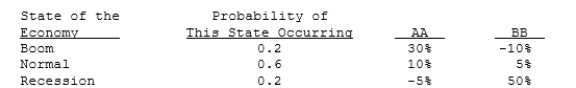

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q98: Stocks A,B,and C all have an expected

Q104: We would generally find that the beta

Q118: You have the following data on (1)

Q121: Bob has a $50,000 stock portfolio with

Q123: Which of the following statements is CORRECT?<br><br>A)

Q123: Under the CAPM, the required rate of

Q124: Stock A has a beta of 1.2

Q126: The slope of the SML is determined

Q126: Assume that you hold a well-diversified portfolio

Q127: Mike Flannery holds the following portfolio: <img