Multiple Choice

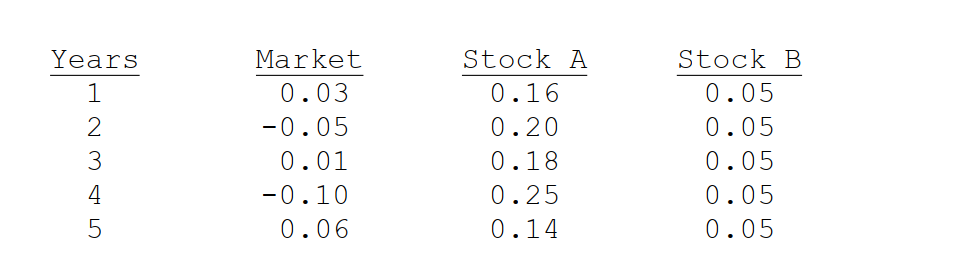

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and

B. Which of the possible answers best describes the historical betas for A and B?

A) bA > 0; bB = 1.

B) bA > +1; bB = 0.

C) bA = 0; bB = -1.

D) bA < 0; bB = 0.

E) bA < -1; bB = 1.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Bad managerial judgments or unforeseen negative events

Q68: Mulherin's stock has a beta of 1.23,its

Q98: Stocks A,B,and C all have an expected

Q104: We would generally find that the beta

Q114: Consider the following information for three stocks,

Q116: Which of the following statements is CORRECT?

Q121: Bob has a $50,000 stock portfolio with

Q122: The distributions of rates of return for

Q123: Which of the following statements is CORRECT?<br><br>A)

Q126: The slope of the SML is determined