Multiple Choice

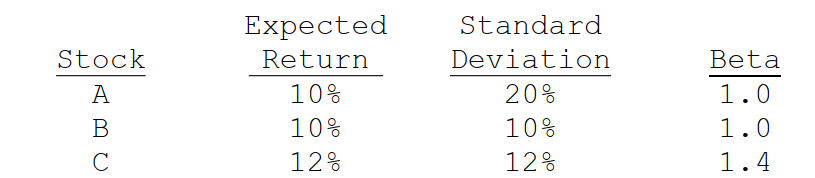

Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

A) Portfolio AB has a standard deviation of 20%.

B) Portfolio AB's coefficient of variation is greater than 2.0.

C) Portfolio AB's required return is greater than the required return on Stock A.

D) Portfolio ABC's expected return is 10.66667%.

E) Portfolio ABC has a standard deviation of 20%.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Stock A has an expected return of

Q32: Bad managerial judgments or unforeseen negative events

Q68: Mulherin's stock has a beta of 1.23,its

Q98: Stocks A,B,and C all have an expected

Q104: We would generally find that the beta

Q110: Tom O'Brien has a 2-stock portfolio with

Q112: Choudhary Corp believes the following probability

Q116: Which of the following statements is CORRECT?

Q118: You have the following data on (1)

Q133: A portfolio's risk is measured by the