Multiple Choice

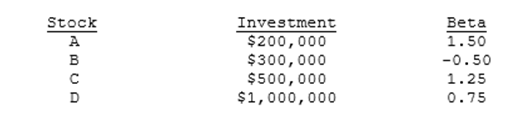

Consider the following information and then calculate the required rate of return for the Global Investment Fund, which holds 4 stocks. The market's required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows:

A) 9.58%

B) 10.09%

C) 10.62%

D) 11.18%

E) 11.77%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The standard deviation is a better measure

Q17: Assume that the risk-free rate, rRF, increases

Q24: The slope of the SML is determined

Q32: Suppose you hold a portfolio consisting of

Q49: Assume that the risk-free rate is 6%

Q51: Engler Equipment has a beta of 0.88

Q52: Data for Dana Industries is shown below.

Q53: Stock HB has a beta of 1.5

Q87: Which of the following statements is CORRECT?<br>A)

Q100: Which of the following statements is CORRECT?<br>A)