Multiple Choice

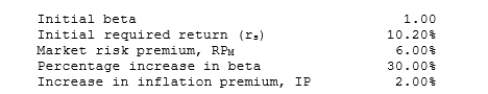

Data for Dana Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 30%. In addition, expected inflation increases by 2.00%. What is the stock's new required rate of return?

A) 14.00%

B) 14.70%

C) 15.44%

D) 16.21%

E) 17.02%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The standard deviation is a better measure

Q32: Suppose you hold a portfolio consisting of

Q48: Consider the following information and then calculate

Q49: Assume that the risk-free rate is 6%

Q51: Engler Equipment has a beta of 0.88

Q53: Stock HB has a beta of 1.5

Q55: Returns for the Dayton Company over the

Q57: Stock A's beta is 1.5 and Stock

Q60: The Y-axis intercept of the SML represents

Q80: Stock A's beta is 1.5 and Stock