Multiple Choice

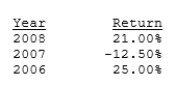

Returns for the Dayton Company over the last 3 years are shown below. What's the standard deviation of the firm's returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.)

A) 20.08%

B) 20.59%

C) 21.11%

D) 21.64%

E) 22.18%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The standard deviation is a better measure

Q51: Engler Equipment has a beta of 0.88

Q52: Data for Dana Industries is shown below.

Q53: Stock HB has a beta of 1.5

Q57: Stock A's beta is 1.5 and Stock

Q59: The CAPM is built on historic conditions,

Q60: The Y-axis intercept of the SML represents

Q61: During the coming year, the market risk

Q80: Stock A's beta is 1.5 and Stock

Q87: Stock A has an expected return of