Multiple Choice

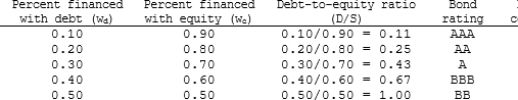

Aaron Athletics is trying to determine its optimal capital structure. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the

Following table:

The company uses the CAPM to estimate its cost of common equity, rs.

The risk-free rate is 5% and the market risk premium is 6%. Aaron estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is the company's optimal capital structure, and what is the firm's cost of capital at this optimal

Capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Whenever a firm borrows money, it is

Q23: Different borrowers have different risks of bankruptcy,

Q61: Vu Enterprises expects to have the following

Q63: Other things held constant, which of the

Q64: Barnes Baskets, Inc. (BB) currently has zero

Q65: Powell Plastics, Inc. (PP) currently has zero

Q66: Ang Enterprises has a levered beta of

Q68: Volunteer Fabricators, Inc. (VF) currently has

Q70: A consultant has collected the following information

Q75: Firm A has a higher degree of