Multiple Choice

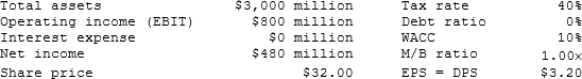

A consultant has collected the following information regarding Young Publishing:  The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3,200

B) $3,600

C) $4,000

D) $4,200

E) $4,800

Medium/Hard:

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Whenever a firm borrows money, it is

Q23: Different borrowers have different risks of bankruptcy,

Q61: Vu Enterprises expects to have the following

Q63: Other things held constant, which of the

Q64: Barnes Baskets, Inc. (BB) currently has zero

Q65: Powell Plastics, Inc. (PP) currently has zero

Q66: Ang Enterprises has a levered beta of

Q67: Aaron Athletics is trying to determine its

Q68: Volunteer Fabricators, Inc. (VF) currently has

Q75: Firm A has a higher degree of