Multiple Choice

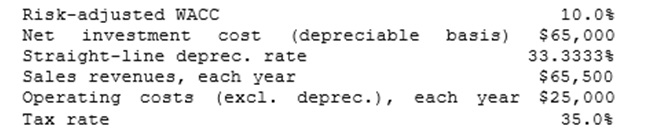

Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

A) $15,740

B) $16,569

C) $17,441

D) $18,359

E) $19,325

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Changes in net working capital should not

Q55: Rowell Company spent $3 million two years

Q57: Florida Car Wash is considering a new

Q58: Which of the following statements is CORRECT?<br>A) Sensitivity

Q60: Suppose Tapley Inc. uses a WACC of

Q61: Which of the following statements is CORRECT?<br>A)

Q62: Which one of the following would <u>NOT</u>

Q63: Marshall-Miller & Company is considering the purchase

Q64: Sub-Prime Loan Company is thinking of opening

Q71: In cash flow estimation, the existence of