Multiple Choice

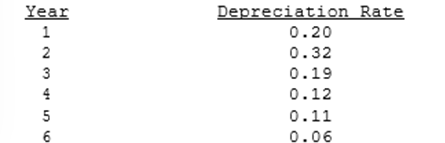

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $ 8,878

B) $ 9,345

C) $ 9,837

D) $10,355

E) $10,900

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Any cash flows that can be classified

Q45: Changes in net working capital should not

Q57: Florida Car Wash is considering a new

Q58: Which of the following statements is CORRECT?<br>A) Sensitivity

Q59: Temple Corp. is considering a new project

Q60: Suppose Tapley Inc. uses a WACC of

Q60: Typically, a project will have a higher

Q61: Which of the following statements is CORRECT?<br>A)

Q62: Which one of the following would <u>NOT</u>

Q64: Sub-Prime Loan Company is thinking of opening