Multiple Choice

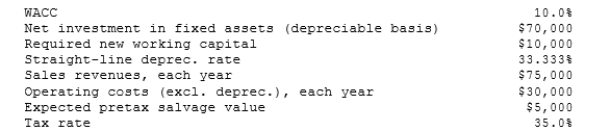

Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following statements is CORRECT?<br>A)

Q8: It is extremely difficult to estimate the

Q9: A company is considering a proposed new

Q10: Taussig Technologies is considering two potential projects,

Q11: Which of the following statements is CORRECT?<br>A)

Q14: Which of the following statements is CORRECT?<br>A)

Q16: Langston Labs has an overall (composite) WACC

Q17: Which of the following factors should be

Q18: Which of the following <u>should be considered</u>

Q31: Since the focus of capital budgeting is