Multiple Choice

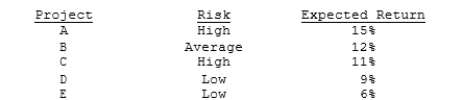

Langston Labs has an overall (composite) WACC of 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Langston evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects:  Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: It is extremely difficult to estimate the

Q11: Which of the following statements is CORRECT?<br>A)

Q13: Foley Systems is considering a new investment

Q14: Which of the following statements is CORRECT?<br>A)

Q17: Which of the following factors should be

Q18: Which of the following <u>should be considered</u>

Q19: When evaluating a new project, firms should

Q21: Thomson Media is considering some new equipment

Q31: Since the focus of capital budgeting is

Q42: Suppose Walker Publishing Company is considering bringing