Multiple Choice

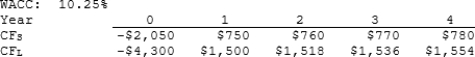

Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

Correct Answer:

Verified

Correct Answer:

Verified

Q3: An increase in the firm's WACC will

Q5: Which of the following statements is CORRECT?<br><br>A) Depreciation

Q6: Barry Company is considering a project that

Q7: Hindelang Inc. is considering a project that

Q10: Which of the following statements is CORRECT?<br>A)

Q11: A company is choosing between two projects.

Q13: Data Computer Systems is considering a project

Q42: Assuming that their NPVs based on the

Q51: Which of the following statements is CORRECT?

Q57: Which of the following statements is CORRECT?<br>A)