Multiple Choice

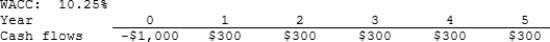

Harry's Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Which of the following statements is CORRECT?<br>A)

Q33: The phenomenon called "multiple internal rates of

Q56: A basic rule in capital budgeting is

Q73: Nast Inc. is considering Projects S and

Q74: Moerdyk & Co. is considering Projects S

Q76: Fernando Designs is considering a project that

Q77: Maxwell Feed & Seed is considering a

Q79: Tuttle Enterprises is considering a project that

Q81: Which of the following statements is CORRECT?<br>A)

Q83: You are considering two mutually exclusive, equally