Multiple Choice

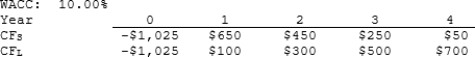

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

A) $5.47

B) $6.02

C) $6.62

D) $7.29

E) $7.82

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Conflicts between two mutually exclusive projects occasionally

Q21: Which of the following statements is CORRECT?

Q33: Which of the following statements is CORRECT?<br>A)

Q59: Project S has a pattern of high

Q69: Lasik Vision Inc. recently analyzed the project

Q73: Nast Inc. is considering Projects S and

Q76: Fernando Designs is considering a project that

Q77: Maxwell Feed & Seed is considering a

Q78: Harry's Inc. is considering a project that

Q79: Tuttle Enterprises is considering a project that