Multiple Choice

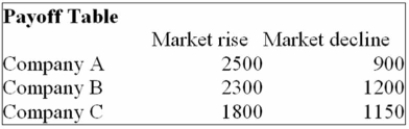

You are trying to decide in which of the three companies you should invest. Refer to the following

Payoff Table.

If the probability of the market declining in the next year is 0.4, which of the following statements

Are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,980.

ii. The Expected value of stock purchased under conditions of certainty is $120.

iii. The Expected value of stock purchased under conditions of certainty is $440.

A) (i) , (ii) , and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii) .

C) (ii) is a correct statement but not (i) or (iii) .

D) (iii) is a correct statement but not (i) or (ii) .

E) (i) , (ii) , and (iii) are all false statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: i. Long-term forecasts are usually from one

Q4: Listed below is the net sales in

Q5: For an annual time series extending from

Q6: Which of the following is true for

Q9: For a three-year moving average, how many

Q10: Determine the expected value for the following

Q11: You have a decision to invest $10,000

Q12: Suppose that the below represents the opportunity

Q13: If the exports ($ millions) for the

Q70: If a quarterly seasonal index is 0.56,