Multiple Choice

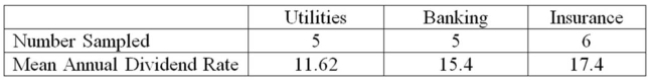

The annual dividend rates for a random sample of 16 companies in three different industries,

Utilities, banking, and insurance were recorded. The ANOVA comparing the mean annual dividend

Rate among three industries rejected the null hypothesis that the dividend rates were equal. The

Mean Square Error (MSE) was 3.36. The following table summarized the results:

Based on the comparison between the mean annual dividend rate for companies in utilities and

Banking, the 95% confidence interval shows an interval of 1.28 to 6.28 for the difference. This result

Indicates that _____________________.

A) there is no significant difference between the two rates

B) the interval contains a difference of 5.00

C) the annual dividend rate in the utilities industry is significantly less than the annual dividend rate in the banking industry

D) the annual dividend rate in the banking industry is significantly less than the annual dividend rate in the utilities industry

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Two accounting professors decided to compare the

Q74: i. If the computed value of F

Q75: A manufacturer of automobile transmissions uses three

Q76: In an effort to determine the most

Q77: Suppose a package delivery company purchased 14

Q79: A random sample of 30 executives from

Q80: A manufacturer of automobile transmissions uses three

Q81: In a study of low tar cigarettes,

Q82: i. If the computed value of F

Q83: Two accounting professors decided to compare the