Essay

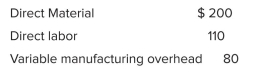

White Water Rafting Company manufactures kayaks, which sell for $565 each.The variable costs of production (per unit) are as follows:  Budgeted fixed overhead in 20x1 was $400,000 and budgeted production was 50,000 kayaks.The year's actual production was 50,000 units, of which 47,000 were sold.Variable selling and administrative costs were $5 per unit sold; fixed selling and administrative costs were $75,000. Required: 1.Calculate the product cost per kayak under (a) absorption costing and (b) variable costing. 2.Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3.Reconcile reported operating income under the two methods using the shortcut method.

Budgeted fixed overhead in 20x1 was $400,000 and budgeted production was 50,000 kayaks.The year's actual production was 50,000 units, of which 47,000 were sold.Variable selling and administrative costs were $5 per unit sold; fixed selling and administrative costs were $75,000. Required: 1.Calculate the product cost per kayak under (a) absorption costing and (b) variable costing. 2.Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3.Reconcile reported operating income under the two methods using the shortcut method.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: All of the following are inventoried under

Q44: Which of the following conditions would cause

Q45: Callaway Corp., which began business at the

Q47: Required: Prepare a quality-cost report.

Q51: Montana Industries has the following costs for

Q54: Fort Smith Technologies incurred the following costs

Q55: All of the following costs are inventoried

Q60: When units sold exceed units produced, absorption-costing

Q61: Absorption costing is required for tax purposes.

Q64: Absorption costing is inconsistent with CVP analysis.