Multiple Choice

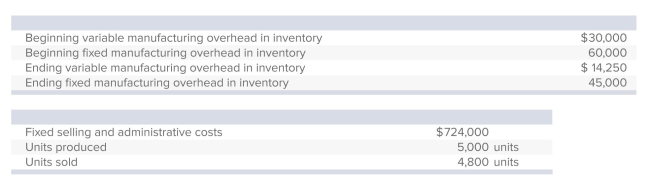

Montana Industries has the following costs for the year just ended:  What is the difference between operating incomes under absorption costing and variable costing?

What is the difference between operating incomes under absorption costing and variable costing?

A) $15,000.

B) $30,750.

C) $750.

D) $7,500.

E) None of the answers is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Total quality management or TQM refers to

Q40: All of the following are inventoried under

Q44: Which of the following conditions would cause

Q47: Required: Prepare a quality-cost report.

Q50: White Water Rafting Company manufactures kayaks, which

Q54: Fort Smith Technologies incurred the following costs

Q55: All of the following costs are inventoried

Q60: When units sold exceed units produced, absorption-costing

Q61: Absorption costing is required for tax purposes.

Q64: Absorption costing is inconsistent with CVP analysis.